How to Break the “Add to Cart” Habit

Learn how to break the add to cart habit with simple rules to curb online shopping, save money, and declutter your home.

What started as a convenience can turn into an add-to-cart habit for many reasons. A quick search for a household need can easily turn into a cycle of daily deliveries that crowd your home and drain your bank account.

Do you click the add to cart button when you’re bored? When you’re watching the latest reel from your favorite influencer on Instagram? Or maybe you’re shopping because you’re depressed or upset. I’m guilty of doing it, and it gives you instant satisfaction that you did something you can control.

But, is mindless shopping for things you don’t really need going to change all those things for you? You may feel better in the moment, but in the long run, you’re just adding more stuff to your home that you don’t need.

Identifying the “Why”

Why do you do it? What makes you click that button and purchase items that you don’t need?

The Dopamine Hit

Dopamine is the brain’s “anticipation” chemical. Interestingly, your brain releases more dopamine during the search and purchase than when the item actually arrives.

- The Hunt: Scrolling through pages of items feels like a treasure hunt. Each new image provides a tiny spark of excitement.

- The “One-Click” Rush: Completing a transaction provides an immediate sense of accomplishment or a “reward” that can temporarily mask feelings of stress, boredom, or restlessness.

- The Arrival: Once the box is opened, the dopamine levels drop. This “post-purchase crash” is often why the item ends up sitting in its packaging on the kitchen counter for three days—the thrill was in the buying, not the owning.

The Search for Connection

Often, we use shopping to fill a social or emotional gap. In a busy household, your days are naturally filled with “pings” of connection—conversations, chores, and the needs of others. When life slows down, and you have an empty nest, the silence can feel heavy.

- The Delivery as an Event: A package arriving at the door can feel like a visit from a friend or a “gift” to yourself, breaking up the monotony of a quiet afternoon.

- The Fantasy Version of You: We buy items for the person we plan to be in this new chapter (the gourmet cook, the gardener, the hiker) rather than the person we are.

Breaking this cycle isn’t about never buying online again; it’s about adjusting your habits so you spend less and live well.

Ready to break that “add to cart” habit? Let’s do it!

Breaking the “Add to Cart” Habit

1. The 72-Hour Rule

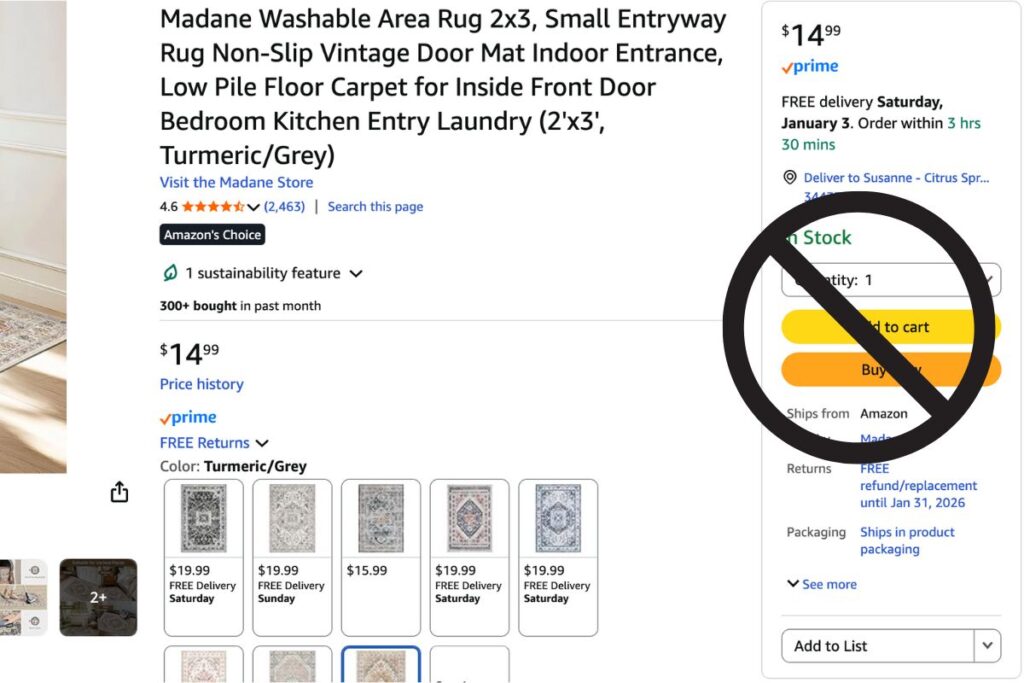

The biggest enemy of a simplified budget is the impulse buy. Online retailers make it incredibly easy to go from “just looking” to “order confirmed” in under thirty seconds. To break this cycle, try implementing a mandatory 72-hour cooling-off period for any non-essential purchase.

Here is how it works: When you find something you want, add it to your cart or a “wish list,” but do not check out. Walk away from the computer or put your phone down. Give yourself three full days to let the initial excitement wear off.

During those 72 hours, ask yourself these three questions:

- Where will this live? Visualize exactly which shelf or drawer this item will occupy. If you have to move three other things to make it fit, it’s probably not worth it.

- What is the real cost? Remind yourself that the price isn’t just the dollar amount; it’s the time you’ll spend cleaning, maintaining, or eventually decluttering it.

- Am I bored or am I in need? Often, we realize by day two that we only wanted the item because we were looking for a quick distraction.

Most of the time, you’ll find that by the third day, the “must-have” feeling has vanished, or you have forgotten about it altogether. If you still truly need the item after three days, you can buy it knowing it was a conscious choice rather than an impulsive reaction.

2. Make It Harder to Pay

Convenience is the greatest tool online retailers have. When your credit card information is saved in your browser or your favorite shopping app, you can spend money without ever having to pause and think.

To break the cycle, you need to deliberately add a little “friction” back into the process.

Go into your account settings on sites like Amazon, Target, or eBay and delete your saved payment methods. Then, go into your phone or computer settings and turn off “Auto-fill” for credit cards.

By doing this, you force yourself to physically get up, find your wallet, and manually type in those sixteen digits every time you want to buy something. That extra minute of effort serves as a built-in speed bump.

It gives your brain a chance to catch up with your impulses. Often, the simple annoyance of having to find your card is enough to make you realize you don’t actually want the item that badly.

3. The “Unsubscribe” Power Hour

The most effective way to stop spending is to stop being “sold” to. Retailers spend millions on emails designed to make you feel like you’re missing out on a deal.

If your inbox is full of “Flash Sale” alerts and “Limited Time Offer” banners, you’re constantly fighting a battle against temptation that you don’t need to be in.

Set a timer for 60 minutes this week and go on an unsubscribing spree. Don’t just delete the emails, scroll to the very bottom and click that tiny “Unsubscribe” link.

Focus on these three categories:

- The “Big Box” Stores: Clear out the daily flyers from places where you tend to overbuy household items or decor.

- The “Niche” Hobby Sites: If you signed up for newsletters for a hobby you no longer pursue, let them go. They only serve to make you feel guilty for not spending time or money on them.

- The Coupon Aggregators: Sites like RetailMeNot and Rakuten that promise to “save you money” usually just encourage you to spend money you weren’t planning to use in the first place.

If you’re worried about missing a genuine “need,” remember that you can always search for a coupon code after you’ve decided you actually need something. You don’t need a daily reminder to spend your hard-earned money.

By the end of the hour, your inbox will be quieter, and your “Add to Cart” triggers will be significantly reduced.

4. Stop the Scroll-to-Spend

Social media algorithms are incredibly good at figuring out what you’re interested in, often before you even realize it yourself. Have you ever had an ad pop up after you’ve been talking with your spouse or a friend about something? Super spooky if you ask me.

Whether it’s a “perfect” gadget for your kitchen or a cozy sweater that looks great in a photo, these targeted ads are designed to bypass your logic and hit your “buy” button instantly.

To protect your budget and your home from these high-pressure ads, try these three strategies:

- The “Three-Dot” Rule: Every time an ad appears in your feed, look for the three small dots in the corner. Click them and select “Hide Ad” or “Not Interested.” This tells the algorithm to stop showing you that specific brand and, over time, lowers the number of shopping lures you see.

- Don’t Use “Shop Now” Buttons: These buttons are designed to take you straight to a checkout page where your phone might already have your payment info stored. If you see something that genuinely interests you, take a screenshot and save it. If you still remember it and want it 72 hours later, you can search for it manually in a separate browser.

- Identify your “Scroll Triggers”: We often scroll social media when we are tired, bored, or lonely. These are the exact moments when our willpower is at its lowest. If you find yourself clicking on ads late at night, make it a rule to put your phone in another room an hour before bed.

By treating social media as a place for connection rather than a digital mall, you reclaim control over your environment and your wallet.

5. The One-In, Two-Out Rule

As an empty nester, your goal is likely to create more breathing room in your home, not less. A great way to keep your online shopping in check is to adopt the “One-In, Two-Out” rule. This simple boundary changes the way you look at every potential purchase.

The rule is straightforward: For every new item you bring into your home, you must choose two similar items to donate, sell, or throw away.

- It creates an immediate “cost”: Before you click “buy” on a new pair of shoes, you have to decide which two pairs you’re willing to part with. If you can’t find two things you’re ready to lose, you probably don’t need the new one that badly.

- It stops the “clutter creep”: Most of us have cabinets and closets filled with things we haven’t touched in years. This rule uses new purchases as a catalyst to finally clear out those forgotten corners.

- It shifts your mindset: You stop being a “collector” of things and start being a “curator” of your space. You begin to value the empty shelf more than the item that could sit on it.

By following this rule, your home actually gets simpler and lighter every time you shop, rather than more crowded. It turns shopping into a conscious trade-off rather than a mindless addition.

Simplifying your life after 50 isn’t about deprivation; it’s about making room for the experiences and people that matter most. When you break the “Add to Cart” cycle, you aren’t just saving money, you are reclaiming your time and your physical space.

By adding a few simple speed bumps to your shopping habits, you can stop the influx of unnecessary stuff and focus on enjoying the home you’ve worked so hard to build.